I’ve previously written a post about best prepaid cards in Canada.

However, selecting the best travel prepaid card requires a slightly different approach.

Certain factors like exchange rates and cash withdrawal fees become a priority.

In this post, I’ll outline the Top Three prepaid cards for travel in 2024.

Let’s dive right in.

1. Wealthsimple Cash Mastercard

The Wealthsimple Cash Mastercard undoubtedly stands out as the BEST travel card.

Why?

Because it gives you 1% cash back in all your purchases.

This is no-brainer considering the card doesn’t impose any fees whatsoever.

No single bank offers this unless it’s for cards with annual fees.

The card also has no foreign exchange (FX) fees.

This means any foreign purchases or ATM cash withdrawals you make will be charged at the Mastercard spot exchange rate.

You won’t get the absolute best rate out there – but neither will you be overcharged.

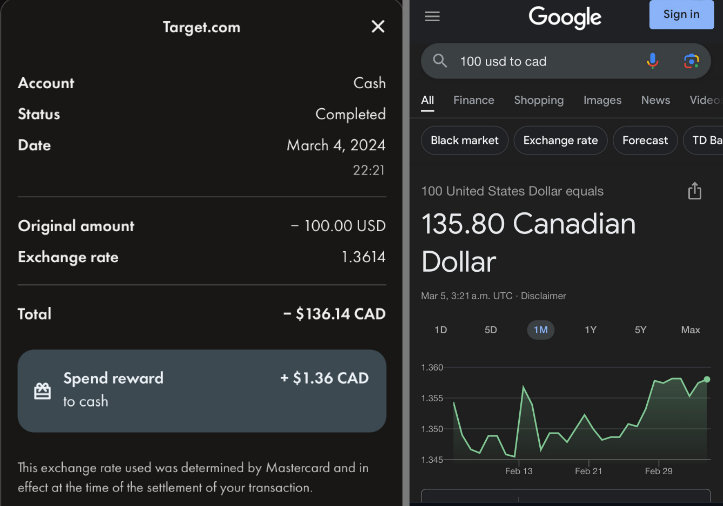

Here’s a quick example of my purchase of $100 USD at Target.

You can see that I was charged at a rate of 1 USD = 1.3614 CAD

The spot rate according to Google at the time of transaction was 1 USD = 1.358 CAD

So I was roughly charged an extra 0.25%, which is significantly lower than the 2.5% FX fees imposed by 90% of the credit cards out there in Canada. (It often surprises me how many Canadians are unaware of these additional fees they incur…)

Now factoring in the 1% cash back Wealthsimple gives, I actually ended up with a net gain of 0.75%.

This is truly a no-brainer, and I hope Wealthsimple can maintain this for the long term.

The benefits don’t stop there…

Wealthsimple DOES NOT CHARGE any fees when withdrawing cash at a foreign ATM.

Although you may encounter $2~3 withdrawal fees imposed by the ATM itself, you can avoid them by referring to my Free ATMs around the world blogpost.

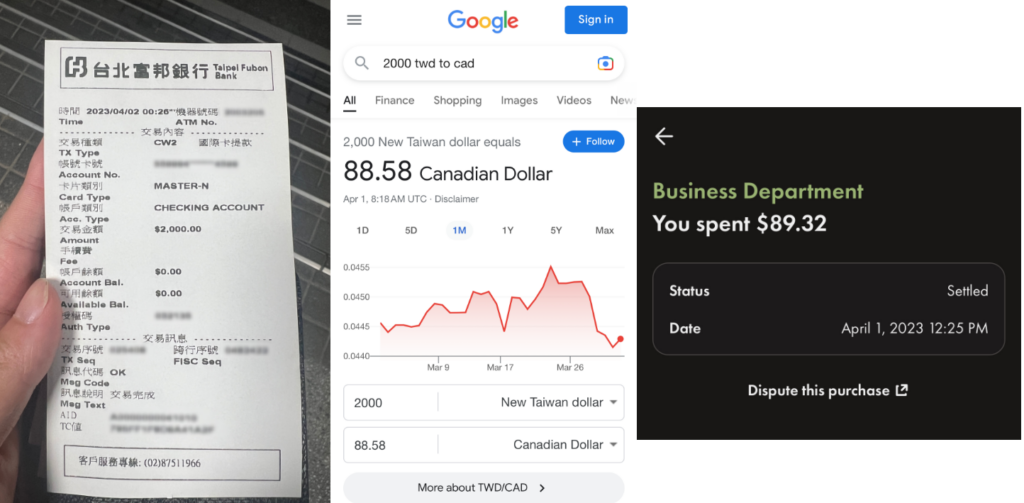

Here’s an example of me withdrawing 2,000 New Taiwan Dollars from an ATM in Taiwan.

I did incur a slightly higher charge compared to the previous example, and I also didn’t receive the 1% cash back since it wasn’t a “spending” (obviously).

But let’s be realistic, what are the odds that I could find a comparable rate at a currency exchange kiosk, especially past midnight? (why did I need cash at midnight? 🤔🍻🍾)

The chances are likely very slim.

Finally, the app is very simple, fast, and easy to use although the app’s UI isn’t really cup of my tea. 😂

Open Wealthsimple AccountFunding methods

- e-Transfer

- Visa debit

- Direct debit

Pros

- No foreign transaction fee

- No ATM Withdrawal fee ($1,000 daily limit)

- 1% cash back for all purchases

- CDIC protection up to $300,000

- Offers a virtual card

- Apple pay / Google pay available

Cons

- The company focuses more on their investing platform

- Unappealing user interface (UI)

2. EQ Bank Mastercard

EQ Bank Mastercard is my second best pick as a travel card.

The card also has NO foreign transaction fee and NO ATM withdrawal fee.

The only feature that’s inferior to the Wealthsimple Mastercard is the 0.5% cash back reward.

Nevertheless, being integrated into a fully functional traditional banking app, it offers a very robust user experience along with complete banking features such as bill payments and cheque deposits.

However, since we’re focusing solely on travel aspect, this point may be somewhat irrelevant.

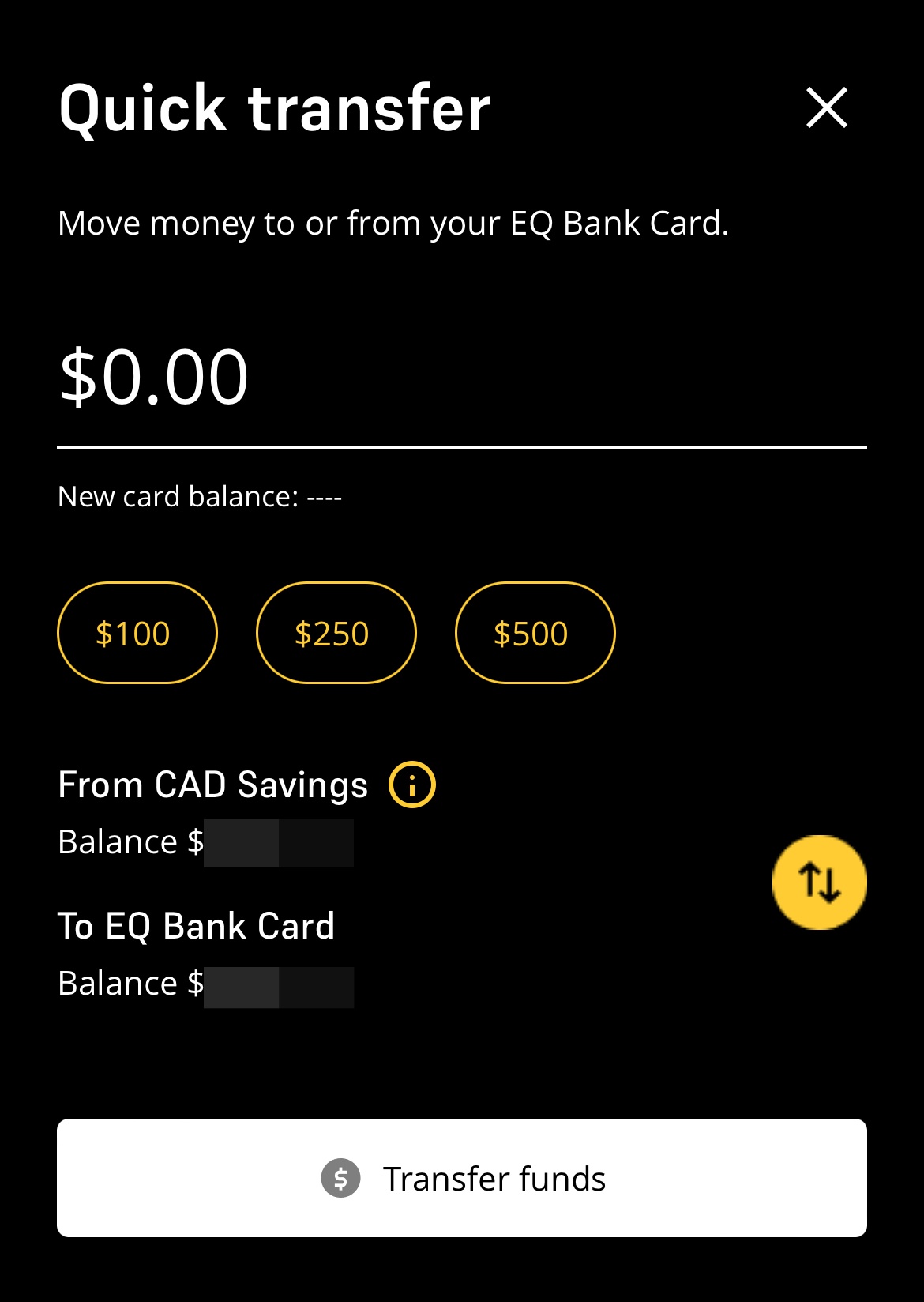

One thing I like about EQ Bank card is the ability to manage your balance separately between your savings account and card balance account.

For instance, you can keep your main balance in the savings account, and transfer only the required amount to the card balance account as needed.

This feature serves as a valuable safety measure in the event of a lost or compromised card.

You can promptly transfer the funds to the savings account to safeguard your funds before contacting customer service to lock your card.

There is some room for improvement though:

- The app is often times very sluggish

From signing in to performing various tasks, I find the app to be slow. - The app/web displays the transaction amount only in CAD

Unless you keep the receipt or memorize the exact transaction amount, you have no way to figure out whether you received a favorable exchange rate or not.

Funding methods

- e-Transfer

- Electronic Funds Transfer

- Cheque deposit

-> Followed by quick transfer from EQ savings account

Pros

- No foreign transaction fee

- No ATM withdrawal fee ($500 daily limit)

- 0.5% cash back for all purchases

- CDIC protection up to $100,000

- Apple pay / Google pay available

Cons

- App is often slow

- Does not show transaction amount in foreign currency

- No virtual card

3. Wise Visa Card

Lastly, we have the Wise card, which isn’t as great as the former two options.

However, as the card is processed by Visa, it can be a great back up in situations where the merchant or ATM only accepts Visa.

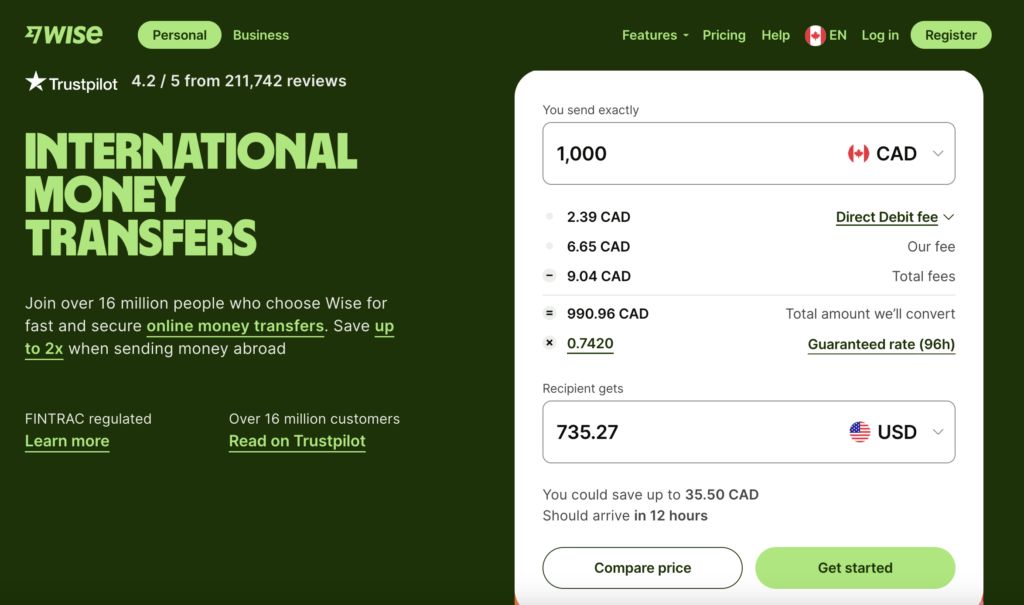

It uses mid-market rate for conversions, much lower than the typical 2.5% charged by Canadian banks.

They also display this information transparently and provide comparisons with other financial services.

I truly appreciate this approach and wish more financial institutions adopt it as a feature.

Before the launch of the Wise Card, its primary market focus was enabling consumers to make exchanges at more favorable rates compared to those offered by large banking institutions.

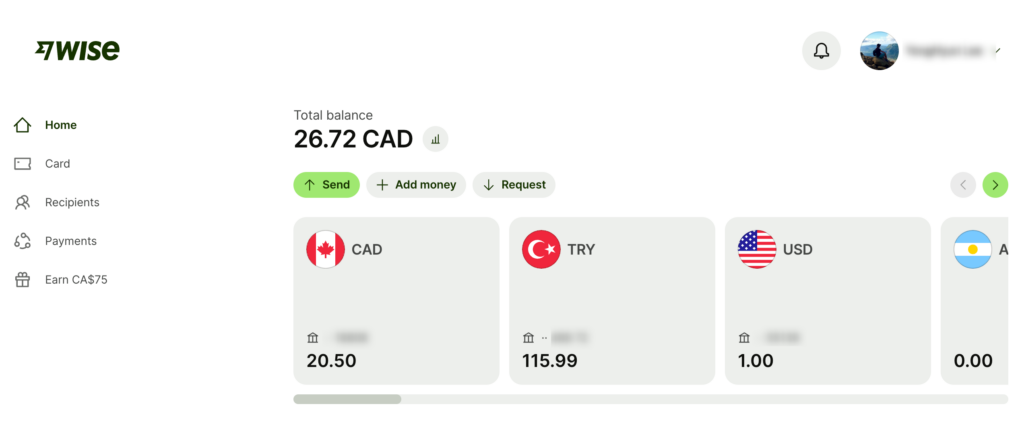

This resulted in a distinctive feature that other cards lack – the ability to hold, spend, and send foreign currency directly to foreign bank accounts.

This can be advantageous as you have an option to convert your money in advance.

For instance, if you’re anticipating a trip to Turkey in the future and the Turkish Lira is currently undervalued in comparison to Canadian dollars, you can exchange your currency to TRY and retain it until your travel date.

Moving onto a slightly negative aspect…

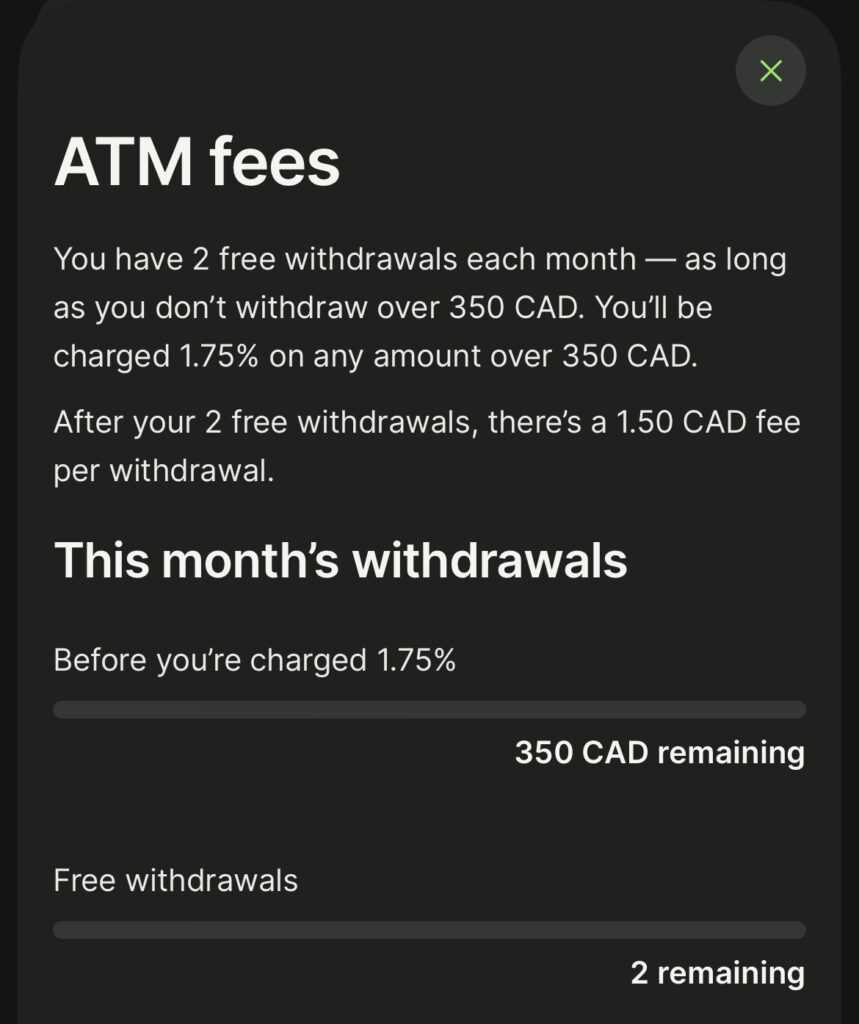

While it offers NO ATM withdrawal fee, the limit is very restrictive.

You can only withdraw up to $350 per month, within 2 transfers, for free.

After that, you’ll be charged a fee of $1.50 + 1.75% of the amount you’re withdrawing, which I find quite bizarre.

One more critical point to mention…

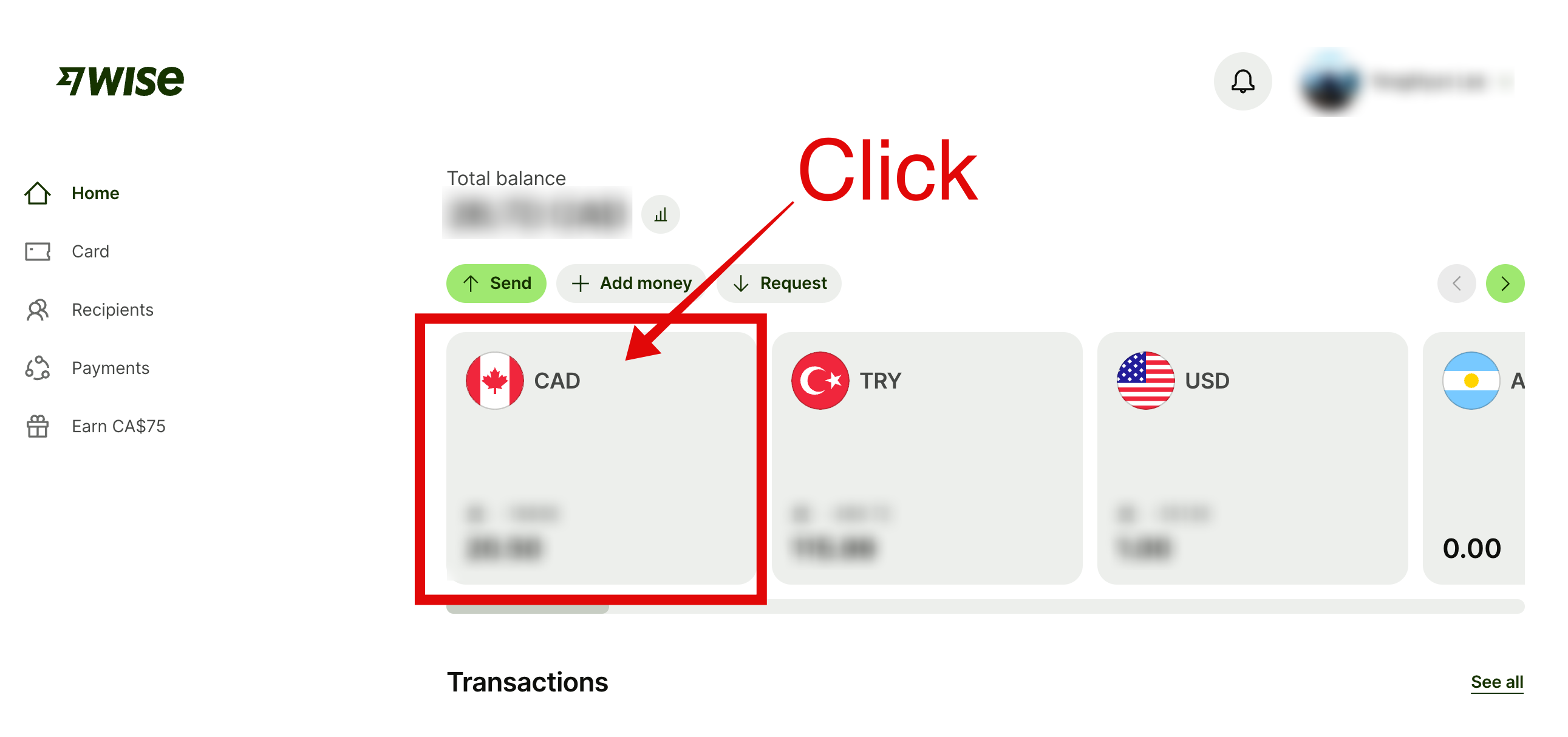

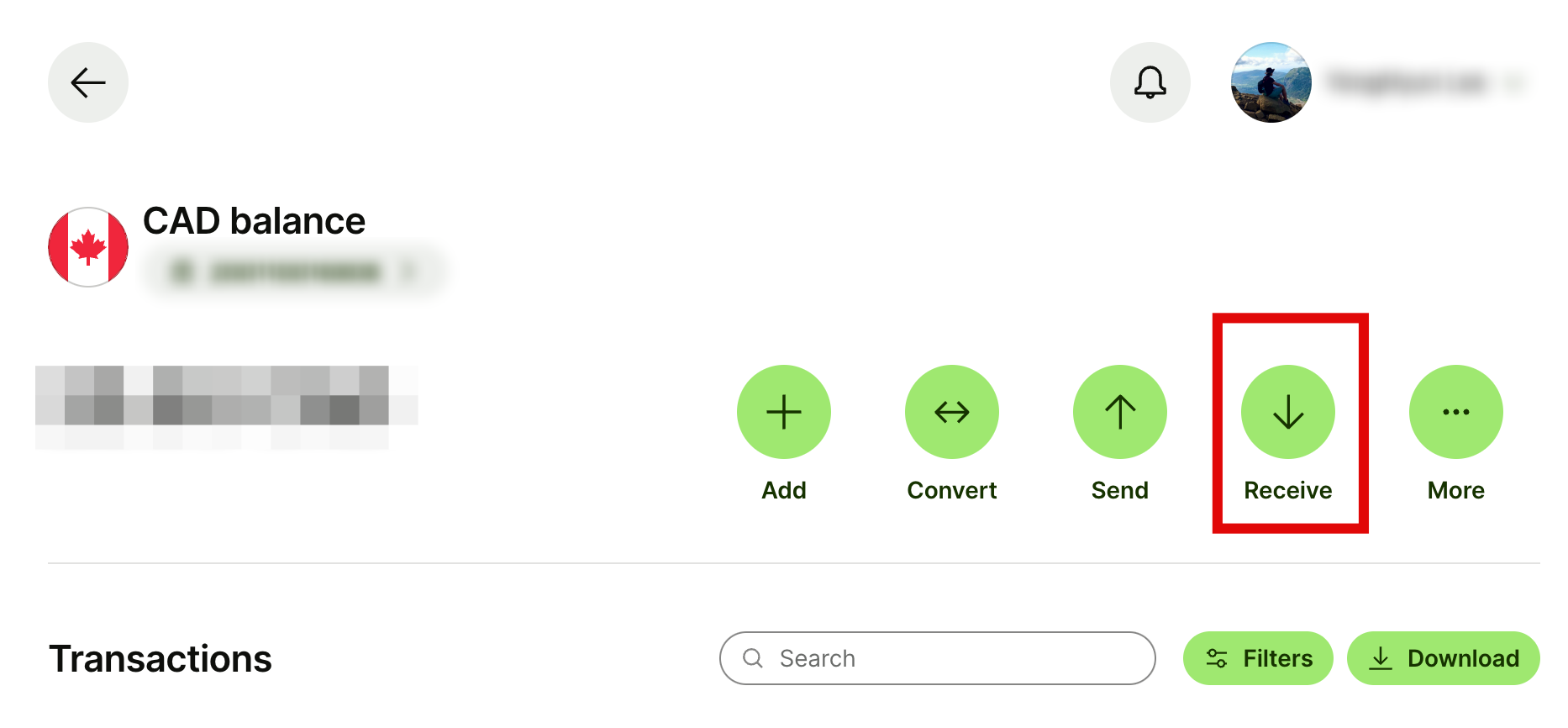

There is one deceptive tactic that I strongly dislike about Wise.

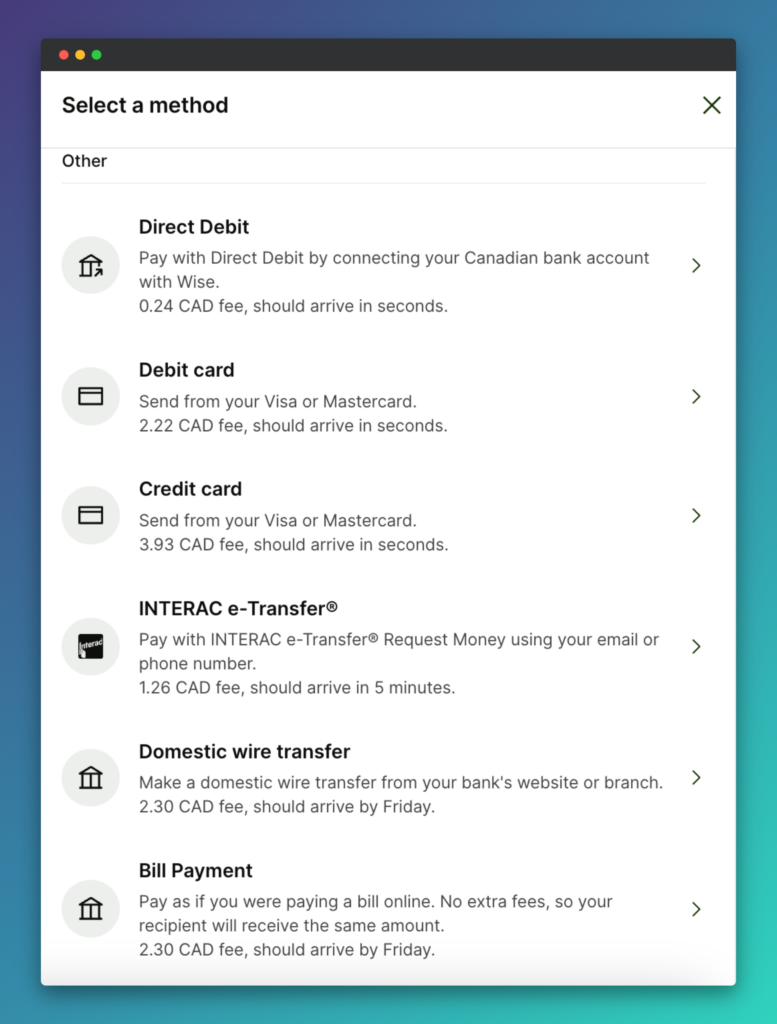

When you try to add funds, you won’t find any option to load for free.

However, there’s actually a method to do it for free, which they don’t explicitly disclose to you.

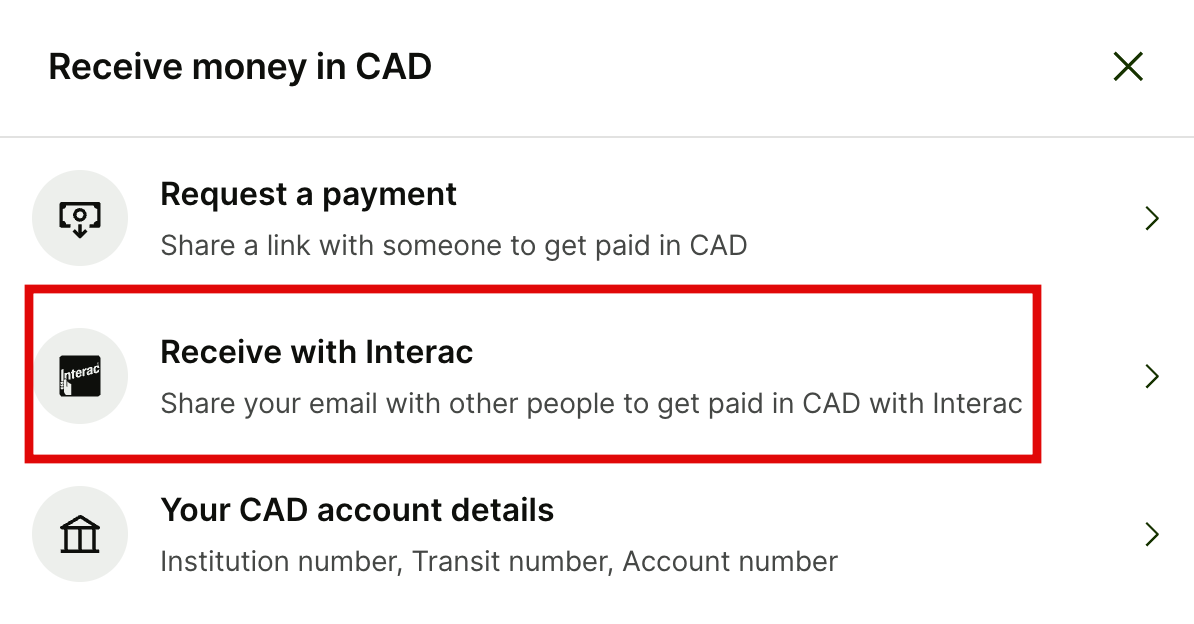

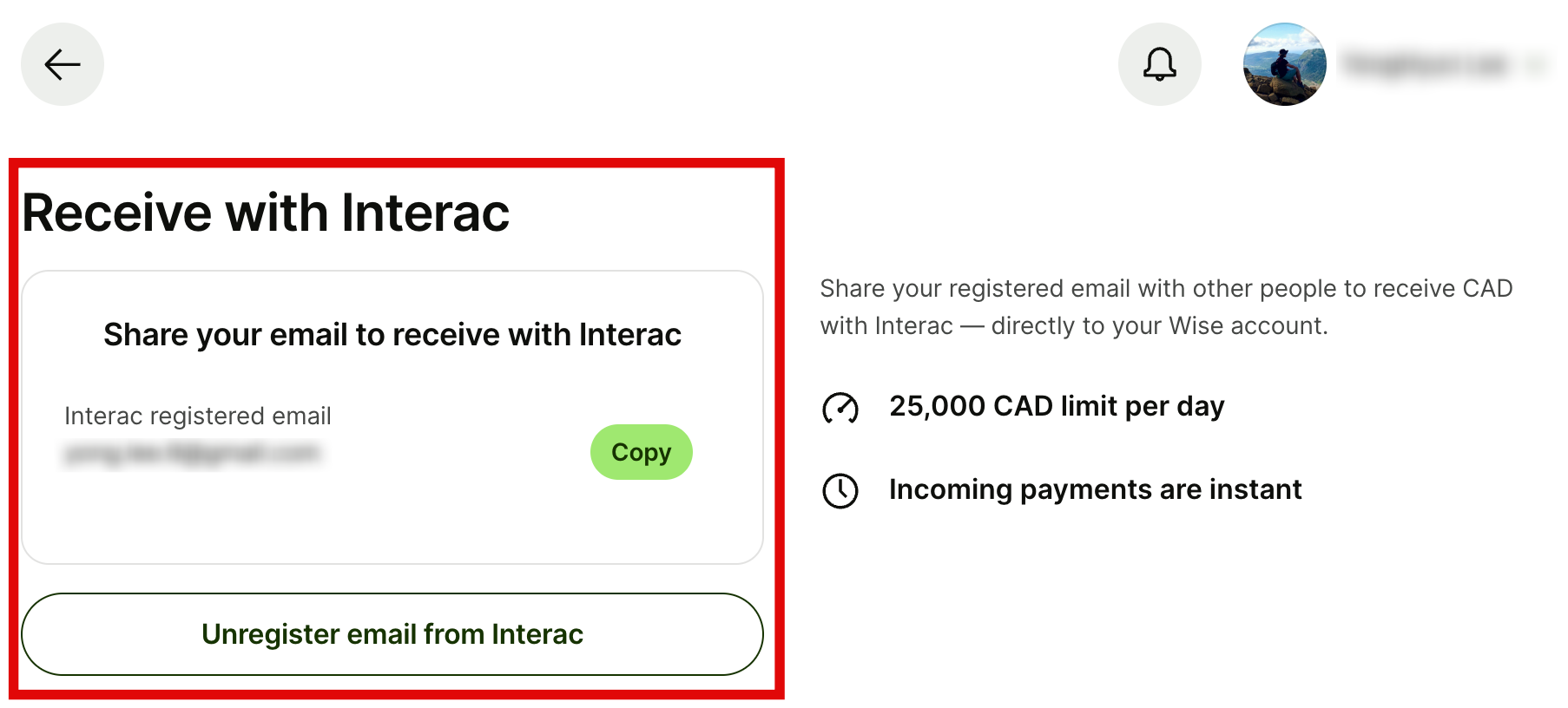

The trick is setting up auto-deposit using your Wise login email.

After this setup, you’d simply send an e-transfer to your Wise email and the funds will be loaded to your Wise account without any fees.

Overall, it is no secret that Wise offers multitude of functions, but it’s a double edge sword.

It makes things quite complex, putting a steep learning curve for the average user to fully capitalize on.

Open Wise AccountFunding methods

- e-Transfer

- Debit/Credit card

- Direct debit

- Domestic wire transfer

- Bill payment

Pros

- Supports 50+ currencies

- International money transfer feature

- offers disposable virtual card

Cons

- No spending rewards

- ATM withdrawal fees after $350

- Complexity of the app

Final Thoughts

Prepaid cards and fintech have been growing rapidly in recent years.

They’ve found success by highlighting features that traditional banks do not offer.

I personally find them very useful during my travels.

While it’s still early days for the industry and things may evolve,

Consider grabbing a Wealthsimple Mastercard for your next trip, and share your experience in the comments below 🙂

[…] best travel card Canada offers will typically have low fees, competitive exchange rates, and wide acceptance across the […]